Global electric car sales for February 2020 were up 16% YoY. Chinese sales collapsed under coronavirus and Europe sales boomed.

EV market news – The UK extends EV subsidies to the 2022-23 financial year. Several EV factories (Tesla, VW, etc.) have had to temporarily close down due to COVID-19.

Beijing explores new policies to spur auto demand. China extends subsidy for NEV purchase and NEV purchase tax exemption for two years.

EV company news – Audi announced a full-blown electric offensive with 17 plug-in models on the market by the end of 2020.

I do much more than just articles at Trend Investing: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Welcome to the March 2020 edition of Electric Vehicle [EV] company news.

The big news this month was really the impact of COVID-19. Last month China sales and production were badly impacted and as China now recovers, global sales and production are now being impacted. This has meant that the German manufacturers have moved towards the top of the sales leader board and the Chinese have fallen, at least for now.

The other big news was both the UK and China extending subsidies for EVs.

Global electric car sales as of end February 2020

Global electric car sales finished February 2020 with 116,000 for the month, up 16% in February 2019, with a market share of 1.6% for February 2020, and 1.8% YTD.

Of note 64% of all global electric car sales in February 2020 were 100% battery electric vehicles [BEVs], the balance being hybrids.

China’s electric car sales were 15,000 in February 2020, down 65% in February 2019 due to the coronavirus lockdown. Conventional car sales were down 82%. Electric car market share in China for February actually rose to 6.6%, and 3.7% YTD.

Subsidies in China were reduced by 20% in 2017 and were reduced again on June 25, 2019. On March 31, 2020 China extended the subsidies for 2 years. China’s Zero Emission Vehicle credit system (NEV credit scheme) in 2020 required 12 points of credits from new energy vehicles [NEVs]. It is currently under consideration to be increased (14 in 2021, 16 in 2022 and 18 in 2023). A December 2019 report from Reuters stated: “China wants new energy vehicle sales in 2025 to be 25% of all car sales.“

Europe’s electric car sales were 69,000 in February 2020, 111% higher than in February 2019. Europe’s electric car market share was 6.5% in February, and 6.5% YTD. Norway still leads the world with an incredible 68% market share in February 2020.

US electric car sales were not reported by EV Sales in February 2020 as it appears many ICE brands don’t want to publish their EV sales numbers.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes of EV Sales and EV Volumes for his excellent work compiling all the electric car sales quoted above and below.

Global electric car sales by manufacturer for February 2020

Source: EV-Sales Blogspot

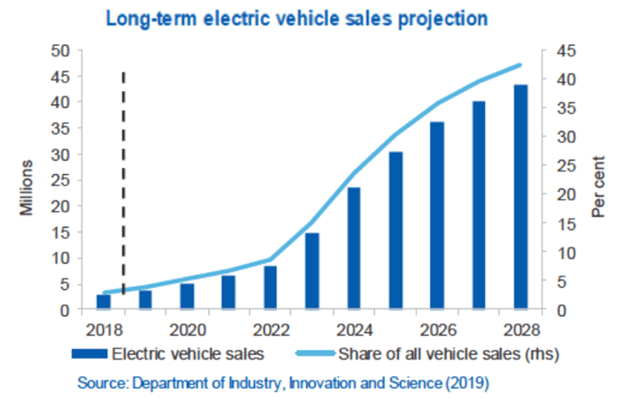

EV sales forecast to really take off from 2022 as affordability kicks in

The chart below aligns with my research that electric car sales will really take-off after 2022, when my model forecasts electric and ICE car price parity.

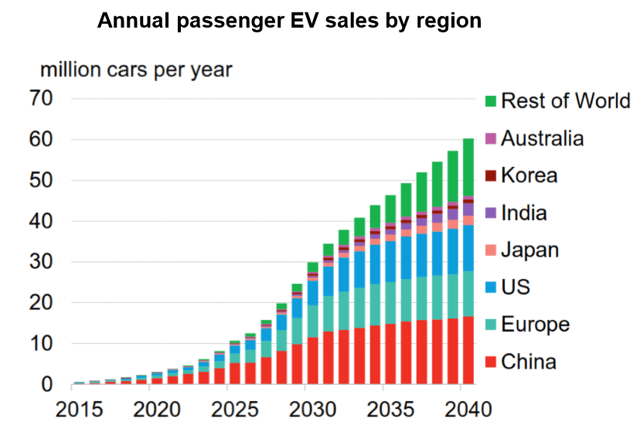

Bloomberg’s forecast for annual electric vehicle sales is 10m by 2025, 28m by 2030, and 56m by 2040. A similar forecast is shown below.

A similar forecast is shown below.

Source: Bloomberg NEF 2019 Electric Vehicle Outlook

EV market news for March 2020

A 2018 report I came across this month stated:

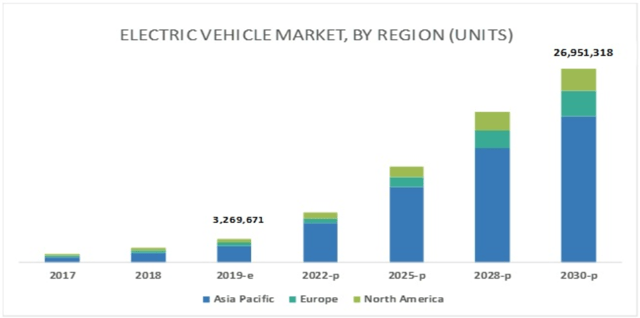

The Electric Vehicles Market is projected to reach 26,951,318 units by 2030 from an estimated 3,269,671 units in 2019, at a CAGR of 21.1% during the forecast period.

Note: What is interesting in the chart below is the forecast massive market share from the Asia Pacific region.

Electric Vehicle forecast to 2030 by region – ~27 million EVs worldwide by 2030

Source: Markets and Markets

On February 23, Inside EVs reported:

EV Subsidies in China might not end in 2020. According to the latest media reports, based on unofficial sources, the Chinese government is currently considering an extension of the subsidies. The original plan was to gradually phase out the incentives by the end of 2020, but taking into consideration the outcome and then the coronavirus, China probably will not only abandon the plans to lower EV subsidies but extend the 25,000 yuan incentive for BEVs with NEDC range of 400 km (250 miles).

On March 2, Investing News reported:

Robert Friedland: Copper is the EV story, demand to rise 900 percent. The dreams of EV makers are not going to become a reality without copper, nickel, lithium and cobalt among other metals, according to Friedland. According to Friedland, by 2030 the Earth’s population will reach 8.5 billion, with at least 5 billion people living in urban areas. As the population grows, the need for quality clean air will increase. Friedland mentioned that nine out of 10 people in the world are breathing polluted air, with some studies showing that it is killing more people than smoking, wars and AIDs combined. The founder of Ivanhoe mentioned how major miners are divesting coal assets or looking for ways to reduce emissions, while carmakers such as Tesla (NASDAQ:TSLA) and Volkswagen (OTC Pink:VLKAF,FWB:VOW) continue to make announcements about upcoming electric car models, which are expected to number 230 by 2021.

On March 11, Argus Media reported:

The UK government has unveiled an extension of its grant scheme for plug-in vehicles in its budget announcement today. The grant of up to 35pc of the vehicle’s value — but with a cap at £3,500 ($4,500) — will be extended until the 2022-23 financial year, overhauling previous plans to abolish it. The grant is available to buyers of any vehicle which emits less than 50g/km of CO2 and can travel at least 112km without any emissions at all. All battery electric vehicles and most plug-in hybrid electric vehicles are eligible. The grant also applies to motorcycles, mopeds and electric taxis. The budget also included an exemption for zero-emission cars from vehicle excise duty, which charges additional taxes on higher-value cars. And UK chancellor Rishi Sunak announced a £500mn investment over five years to support the rollout of a fast-charging network for electric vehicles (EVs), on top of a £1bn investment announced in September 2019 to scale-up EV production in the UK.

On March 17, Bloomberg reported:

An economic crash will slow down the electric vehicle revolution… But not for long. The coronavirus pandemic presents risks but won’t change the longer term trajectory… Sales in Europe still are expected to increase 50% from last year and China sales could be flat or drop if the recovery from the virus drags on.

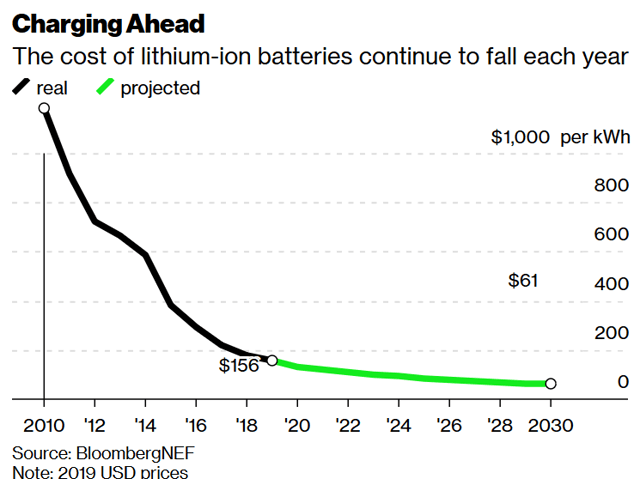

Note: The chart below shows the magic USD100/kWh being in 2023. This is when electric cars will be purchase price competitive with conventional cars. To learn more you can read my recent article: “The EV Disruption Will Really Take Off From End 2022.”

Bloomberg forecasts lithium-ion batteries to keep falling

Source: BNEF

On March 25, Clean Technica reported:

Sweden reaches 26% electric vehicle market share! Being Sweden, the #1 EV in February was, unsurprisingly, a Volvo. Perhaps more surprisingly, according to the EV Volumes data, the next three vehicles on the list were all Kias!

On March 30, Green Car Reports reported:

A new study confirms what electric car drivers already know: that EVs are cleaner than gasoline cars, even when emissions from electricity generation are factored in. Electric cars are in fact cleaner than gasoline cars in 95% of the world, according to a joint study by the Universities of Cambridge, Exeter, and Nijmegen (via BBC News).

On March 30, Automotive News China reported: “Beijing explores new policies to spur auto demand.” This is for all types of autos.

Also a similar article: “Changchun, Ningbo join roster of cities to dangle sales incentives… Volkswagen Group, with plants in both Changchun and Ningbo, will be the main beneficiary of the incentive programs.”

On March 31, Gasgoo reported:

China extends subsidy for NEV purchase for two years. China has determined to extend the validity period of the subsidies on new energy purchases and NEV purchase tax exemption for two years, state media reported on March 31, quoting an executive meeting of the State Council chaired by Chinese Premier Li Keqiang.

Note: Bloomberg also reported: “China extends rebates for electric-car purchases to revive sales. EV sales tax, subsidies to be prolonged an extra two years.”

On March 31, 4-traders reported: (European) Plant shutdowns hit 1.1 million auto workers in Europe – ACEA.”

EV company news

Tesla Inc. (NASDAQ:TSLA)

Tesla is currently ranked number 1 globally with 11% global market share. Tesla is still assumed to be the number 1 electric car seller in the US.

On March 6, Reuters reported:

Tesla wins approval to sell longer-range China-made Model 3 vehicles… The vehicles will have a driving range of more than 600 kilometers before they need to be recharged.

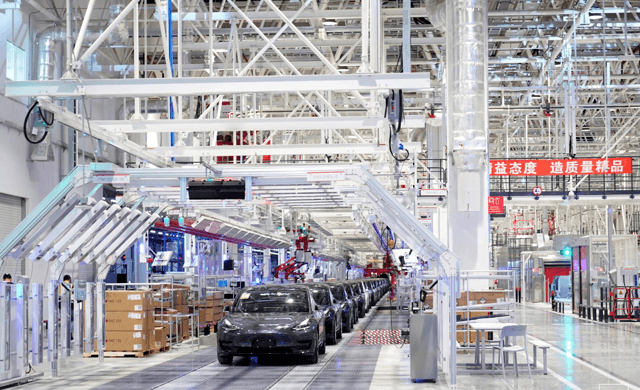

Tesla China-made Model 3 vehicles at the Shanghai gigafactory

On March 11, Green Car Reports reported:

Tesla is looking for a US location to build Cybertruck—and more Model Y. Tesla’s reservation page for its eagerly anticipated Cybertruck still indicates that the company plans to begin deliveries of at least one version in late 2021…

On March 19, Tesla announced:

Tesla operational update… we have decided to temporarily suspend production at our factory in Fremont, from end of day March 23… Basic operations will continue in order to support our vehicle and energy service operations and charging infrastructure… Our factory in New York will temporarily suspend production as well, except for those parts and supplies necessary for service, infrastructure and critical supply chains. Operations of our other facilities will continue, including Nevada and our service and Supercharging network.

On March 20, The Verge reported: Tesla Model Y deliveries begin in the US. Just one year after the electric SUV was unveiled.”

On March 27, the BBC reported: “Coronavirus: Tesla donates hundreds of ventilators to New York.”

Investors can read my June 2019 Blog post: “Tesla – A Look At The Positives And The Negatives,” where I rated the stock a buy. It was trading at USD 196.80.

BMW (OTCPK:BMWYY), Mini

BMW is currently ranked the number 2 global electric car manufacturer with an 8% global market share. BMW is number 1 in Europe with a 12% market share.

On March 3, Bloomberg reported:

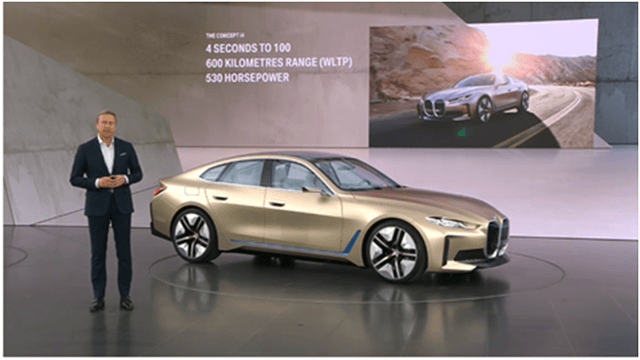

BMW bets on new EV to reclaim crown in entry-level luxury sedans. BMW will introduce an electric version of the popular X3 SUV this year, which will be followed by the futuristic iNEXT SUV and the i4 in 2021. The i4’s electric motor delivers as much as 530 horsepower and can accelerate to 100 kilometers per hour in about four seconds. Its battery will have a range of around 600 kilometers (372 miles).

BMW i4 luxury fully electric sedan due 2021

On March 10, Green Car Reports reported: “BMW confirms iX3 electric SUV isn’t coming to the US.”

BMW iX3 Concept front 3/4

On March 18, Electrek reported: “BMW 7 Series: the top, most powerful trim in next-gen flagship sedan will be all-electric.”

2020 BMW 7 Series

Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTCPK:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/Skoda

Volkswagen is currently ranked the number 3 top-selling global electric car manufacturer with 7% market share, and number 3 in Europe with 8% market share.

On March 3, Bloomberg reported:

VW takes push into electric cars global with plans for new SUV… The marque’s first fully-electric SUV – dubbed ID.4 – is set to help take output of battery-powered vehicles to as many as 1.5 million cars by 2025. “We will produce and sell the ID.4 in Europe, China and the U.S.”… The plan to roll out the German-built ID.3 hatchback this summer still stands.

Note: Eletrek reported the ID.4 will have a 300 mile range ( “up to 500 km” ). The ID.4 is going to launch later this year with the unveil of a production version expected in New York in April. It is expected to go on sale shortly after – starting at ~$40,000.

Volkswagen ID.4 fully electric SUV to launch production later in 2020

Source: Volkswagen

On March 4, Inside EVs reported: “Norway EV sales up in February 2020: Audi E-Tron still on top.”

On March 4, Motor1 reported: “2021 Audi E-Tron GT spied testing for the first time.”

On March 17, Volkswagen reported:

Volkswagen brand suspends production on Thursday due to corona crisis. The Volkswagen Passenger Cars brand is gradually suspending production at its European plants… Initially, the factories are therefore expected to remain closed for two weeks. For the affected German sites, the measures are to apply from the end of the late shift on Thursday.

On March 19, Inside EVs reported:

Audi: 5 EVs and 12 PHEVs to be available by end of 2020. Audi announced a full-blown electric offensive with 17 plug-in models on the market by the end of 2020. Audi recently summarized its 2019 performance and outlined future plans, which include a huge €12 billion investment in electrification.

On March 20, Road Show reported:

Lamborghini production suspended in Italy as coronavirus spreads. The Italian supercar-maker has shut production down for over a week as Italy battles the virus outbreak.

On March 24, Green Car Reports reported:

VW stokes electric Microbus buzz with e-Bulli conversion. The complete conversion is priced starting at 64,900 euros ($69,700).

1966 Volkswagen Samba Bus with EV conversion from eClassics

On March 26, Volkswagen reported: “Volkswagen extends suspension of production.”

On March 30, Automotive News China reported: VW is burning through $2.2B a week as virus halts output.”

Renault (OTC:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY, OTCPK:MMTOF)

Renault is ranked global number 4 globally with a 6% market share, and is currently number 2 in Europe with an 11% market share. Nissan is currently ranked number 6 for global electric car sales with a 5% market share

On March 4, Nissan reported:

Nissan shows how electric vehicles can help fight escalating air pollution. With the Nissan LEAF already saving more than two million metric tons of CO₂ since 2010, electric vehicles are proving to be a sustainable alternative in addressing air pollution.

On March 6, Inside EVs reported:

Nissan LEAF sales in Japan finally surge to almost 3,000. Nissan LEAF delivered a surprisingly good result in February. February 2020 brings some highly needed recovery for Nissan LEAF sales in Japan, where results were recently a little disappointing.

Investors can read my recent Trend Investing article: “The Era Of The Truly Affordable Electric Car Is Finally Arriving Soon Helped By Renault.”

Group PSA – Peugeot SA [FR:UG][PA:PEUP](OTCPK:PEUGF) (OTCPK:PEUGY)/Citroen, Fiat Chrysler (NYSE:FCAU)

Peugeot is ranked global number 5 globally with 5% market share.

On March 9, Inside EVs reported:

Next-Gen Peugeot 108 expected to go electric. Next-generation Peugeot 108 will be electric – maybe using the Fiat 500 BEV platform.

On March 25, 4-traders reported: “Peugeot restarts car production in virus-hit Wuhan with Dongfeng.”

On March 31, 4-traders reported: “Fiat Chrysler does not see delay in PSA merger, FIOM union says.”

Geely Automobile Holdings Ltd (OTCPK:GELYY, HK:0175) (includes Polestar), Volvo Group (OTCPK:VOLVY), Kandi Technologies Group (NASDAQ:KNDI), Proton, Lotus

Volvo is currently ranked number 7 in the global electric car manufacturer’s sales ranking with a 4% global market share.

On March 6, Motor1 reported: “Volvo reportedly planning C40 all-electric coupe crossover.”

Volvo XC40 Recharge

On March 18, Motor1 reported:

Volvo goes green by swapping trucks for trains. The company is using trains for its logistics operations in a move designed to cut emissions.

On March 24, Road Show reported:

Polestar 2 EV production begins, despite COVID-19 spread. Deliveries will first start in Europe, then China and finally, the US.

Hyundai (OTC:HYMTF) Kia (OTC:KIMTF)

Hyundai is currently ranked number 8 for global electric car sales with a 4% market share. Kia is ranked global number 10 and has a 4% market share.

On March 3, Hyundai reported: “Hyundai Motor unveils “Prophecy” concept EV.”

Hyundai Prophecy EV Concept

Beijing Automotive Group Co. (BAIC) [HK:1958) (OTC:BCCMY), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus)

BAIC is currently ranked the global number 20 with 1% market share.

SAIC is global number 9 with a 4% market share, and number 2 in China with 14% market share.

On March 26, BAIC reported: “Annual results announcement for the year ended December 31, 2019.”

On March 30, Automotive News China reported: BAIC, Didi to introduce car-leasing service.”

BYD Co. (OTCPK:BYDDY) (OTCPK:OTCPK:BYDDF) HK:1211

BYD is currently ranked the number 12 globally with a 4% global market share, and is ranked number 1 in China with a 15% market share.

On March 6, Inside EVs reported: “BYD celebrates production of 100,000th Yuan BEV.”

On March 6, Inside EVs reported:

BYD to deliver first 20 electric trucks to Ecuador. “The heavy-duty pure electric truck is equipped with world-leading lithium iron phosphate (LFP) batteries that have a lifespan of 15 years and a range of 150 kilometers on a single charge, complementing the truck’s integrated drive shaft and a unique control system developed by BYD.

On March 23, Inside EVs reported: “BYD plug-in EV car sales dropped down by 80% in February 2020.”

On March 29, Automotive News China reported: “BYD to supply EV parts to rivals.”

Daimler-Mercedes (OTCPK:DDAIF, OTCPK:DDAIY) (Smart – 50% JV between Daimler & Geely)

On March 4, Daimler reported: “Daimler Trucks launches additional electric Freightliner Customer Experience fleet.”

On March 7, Inside EVs reported: “50,000 Mercedes-Benz EQC to be produced this year.”

On March 25, Green Car Reports reported: “Mercedes-Benz teases all-weather potential of EQV electric van.”

Mercedes-Benz EQV testing in Arjeplog, Sweden

General Motors/Chevrolet (NYSE:GM)

On March 3, General Motors reported:

GM continues to facilitate EV adoption, tripling employee workplace electric vehicle charging availability across U.S. and Canada.

On March 4, Seeking Alpha reported:

GM is Morgan Stanley’s top pick in auto. Jonas and team draw some comparisons between GM and Tesla [TSLA -0.4%]. While MS forecasts Tesla to grow EV sales 4X by 2030, GM is expected to grow EV sales by over 30X. Meanwhile, Tesla trades at almost 30X 2021 EBITDA vs. GM’s trading handle of just over 2X.

On March 4, CNBC reported: “General Motors to spend $20 billion through 2025 on new electric and autonomous vehicles through 2025.”

On March 4, General Motors reported: “GM reveals new ultium batteries and a flexible global platform to rapidly grow its EV portfolio.”

On March 24, Automotive News reported: “AutoNews Now: GM to tap $16B from credit lines.”

Toyota (NYSE:TM) Lexus

On March 2, Electrek reported:

Toyota will build an EV plant in Tianjin, China, in 2020… it will build a new electric vehicle plant in cooperation with the First Automobile Works (FAW) in Tianjin, China. The two companies will invest about $1.22 billion in the project. The plant is expected to produce 200,000 battery-only, plug-in hybrid and fuel-cell vehicles every year. The company did not indicate how many units would be electric, plug-in hybrid, or fuel cell.

On March 23, Toyota reported: “Toyota and Hino to jointly develop heavy-duty fuel cell truck.”

On March 30, Benchmark Minerals reported:

Toyota turbo charges EV plan with 60GWh of lithium ion battery capacity by 2025. This is enough battery cells to make just over 1 million electric vehicles [EV] with an average pack size of 55kWh.

Ford (NYSE:F)

On March 3, Green Car Reports reported: “Ford Mustang Mach-E demand goes well beyond the California bubble… Ford reported today that it now has orders for the model in all 50 states. Ford says that the model’s 300-mile EPA-estimated range and all-wheel-drive capability will help meet “regional customer needs.”

2021 Ford Mustang Mach-E

On March 12, Inside EVs reported:

2021 Ford Bronco SUV charges to life in electric Rivian R1S form. Ford has never officially stated that the Bronco will get an electric version.

Rivian Automotive (private)

On March 18, Inside EVs reported: “Check out Rivian R1T electric truck & R1S as Police cruisers.”

Rivian R1T Electric Truck & R1S As Police Cruisers

Nio Inc. (formerly NextEV) (NIO)

On March 18, Nasdaq reported:

Chinese EV maker Nio raises doubts about its future. Cash-strapped Chinese electric vehicle [EV] maker Nio Inc NIO said on Wednesday there was substantial doubt in its ability to continue as a going concern, sending its shares down 12% in premarket U.S. trading.

On March 18, Globe Newswire reported: “NIO Inc. reports unaudited fourth quarter and full year 2019 financial results.”

Fisker (private)

On March 5, The Driven reported:

Fisker Ocean electric SUV has solar roof that adds free 1,600km a year. Announced last year and revealed at CES 2020 in Los Angeles in early January, the Fisker Ocean electric SUV will boast a full-length solar roof which will feed into the vehicles battery and provide “1,000 free, clean miles per year.” Off a single charge, the battery will provide up to 300 miles (482 km) and more than 200 miles (321 km) off a 30-minute charge. Expected to be priced at $US37,499 ($A56,850 converted) the Fisker Ocean is set to go on sale in 2022.

Lucid Motors (formerly Atieva) (private)

On March 4, Forbes reported:

Lucid Motors to open 8 showrooms by end of 2020. Lucid Motors rolled out a retail plan on Wednesday designed to make it a serious alternative to Tesla Motors for consumers looking for upscale electric vehicles. The Newark, California-based EV manufacturer intends to open eight showrooms by the end of this year, five in California, and additional locations in 2021.

On March 6, CleanTechnica reported: “Lucid unveils sales & service model, with first location to open in 2020.”

Nikola Corporation (private)

On March 3, Nikola Corporation announced:

Nikola Corporation, a global leader in zero emissions transportation solutions, to be listed on NASDAQ through a merger with VectoIQ.

On March 9, Road Show reported:

Nikola’s Badger electric truck hopes to take on Hummer and Rivian. Nikola, an electric semi truck-manufacturing hopeful, has unveiled a pickup that will be available with electric and fuel cell powertrains. This new model could come with up to 600 miles of range.

Nikola Motors Badger Electric Truck

Byton (private)

On March 2, Inside EVs reported:

BYTON releases details about M-Byte launch in Europe. Byton has just released a lot of details about the European market launch of its upcoming M-Byte all-electric SUV. The European market seems to be extremely important for the Chinese startup, as the company collected in Europe some 25,000 reservations out of total 65,000 globally.

The car will be available for pre-order from the second-half of 2020 (with a fully refundable down payment of €500), while the deliveries are scheduled for 2021 (“by the end of 2021” to be precise). The price will start at €45,000 ($50,125) excluding VAT tax and any local incentives.

Other EV companies

Other EV companies I am following include Atlis Motors, Chery Automobile Co. Ltd. (private), Didi Chuxing, Dyson (private), Electrameccanica Vehicles Corp. (SOLO), Faraday Future (private), Great Wall Motors, GreenPower Motor Company Inc. [TSXV:GPV] (OTCQX:GPVRF), Guangzhou Automobile Group Co., Honda (HMC, OTCPK:HNDAF), Mahindra & Mahindra (OTC:MAHDY), Mazda (OTCPK:MZDAY), Qiantu Motor, Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Tata Motors (TTM) group (Jaguar, Land Rover), WM Motor, Xiaopeng Motors, and Zhi Dou (private).

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least – Norway (2025), Netherlands (2030), China (?25% EVs by 2025), Germany (?2030), Hong Kong (2030-40), Ireland (2030), Israel (2030), India (30% by 2030), Scotland (2032), UK (2035), France (2040), Taiwan (2040), Singapore (2040), Japan (2050); Rome (2024), Athens (2025), Paris (2025), London, Stuttgart, Mexico City (2025), Madrid (2025), and Amsterdam and Brussels (2030).

Autonomous Driving/Connectivity/Onboard entertainment/Ride-sharing

On March 3, Bloomberg reported:

Alphabet’s (GOOG) (GOOGL) Waymo raises $2.25 billion for driverless cars. The deal helps Google parent Alphabet spread the cost of funding Waymo as the unit pushes ahead to commercialize its autonomous driving technology. Krafcik also suggested the parent company could eventually spin Waymo off into an independent business. Krafcik said Waymo wants to expand its driverless fleet to new locations, mentioning the Middle East as one possibility, but he declined to share details.

On March 18, Bloomberg reported: “Waymo pausing most operations in response to COVID-19.”

On March 30, Bloomberg reported: Driverless cars have arrived, and they all look like loaves of bread. The future will be boxy and utilitarian.

May Mobility Shuttle

Conclusion

February 2020 global electric car sales were 116,000 up 16% YoY, and 1.6% global market share. Electric car market share for February reached 6.6% in China, 6.5% in Europe, and no updated figures for the US.

Highlights for the month were:

- EV Subsidies in China might not end in 2020.

- The UK extends EV subsidies to the 2022-23 financial year.

- Sweden reaches 26% electric vehicle market share!

- Bloomberg – An economic crash will slow down the electric vehicle revolution… But not for long.

- Electric cars are in fact cleaner than gasoline cars in 95% of the world.

- Beijing explores new policies to spur auto demand. China extends subsidy for NEV purchase and NEV purchase tax exemption for two years.

- European auto plant shutdowns hit 1.1 million auto workers in Europe.

- Tesla temporarily suspends production at Freemont and New York. Superchargers, Nevada and service centres to remain open. Tesla Model Y deliveries begin in the US. Tesla donates ventilators to New York.

- BYD to deliver first 20 electric trucks to Ecuador. BYD plug-in EV car sales dropped down by 80% in February 2020, due to the coronavirus. BYD to supply EV parts to rivals.

- BMW i4 luxury fully electric sedan due 2021 with a range of 372 miles (600 kms). BMW 7 Series: the top, most powerful trim in next-gen flagship sedan will be all-electric.

- Geely – Polestar 2 EV production begins.

- Volkswagen plans for new SUV – ID.4. It should have ~300 miles (up to 500kms) of range and be available late 2020 starting at ~$40,000. The Volkswagen passenger cars brand is gradually suspending production at its European plants, scheduled to last for 2 weeks.

- Audi announced a full-blown electric offensive with 17 plug-in models on the market by the end of 2020.

- Toyota will build an EV plant in Tianjin, China, in 2020, with First Automobile Works (FAW). Toyota and Hino to jointly develop heavy-duty fuel cell truck.

- General Motors to spend $20 billion through 2025 on new electric and autonomous vehicles through 2025.

- Peugeot – Next-Gen Peugeot 108 expected to go electric.

- Cash-strapped Chinese EV maker Nio raises doubts about its future.

- Alphabet’s Waymo raises $2.25 billion for driverless cars.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I’ve done, especially in the electric vehicle and EV metals sector. You can learn more by reading “The Trend Investing Difference“, “Subscriber Feedback On Trend Investing”, or sign up here.

Trend Investing articles:

- The EV Metals Miners Are The Cheapest They Have Been Since 2015/16

- The Australian Index Is On A 33% Discount Sale And A 7.76% Yield Due To The Coronavirus

Disclosure: I am/we are long BYD CO (HK:1211), TESLA (TSLA), RENAULT [FR:RNO]. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.